March 25, 2023 8:24

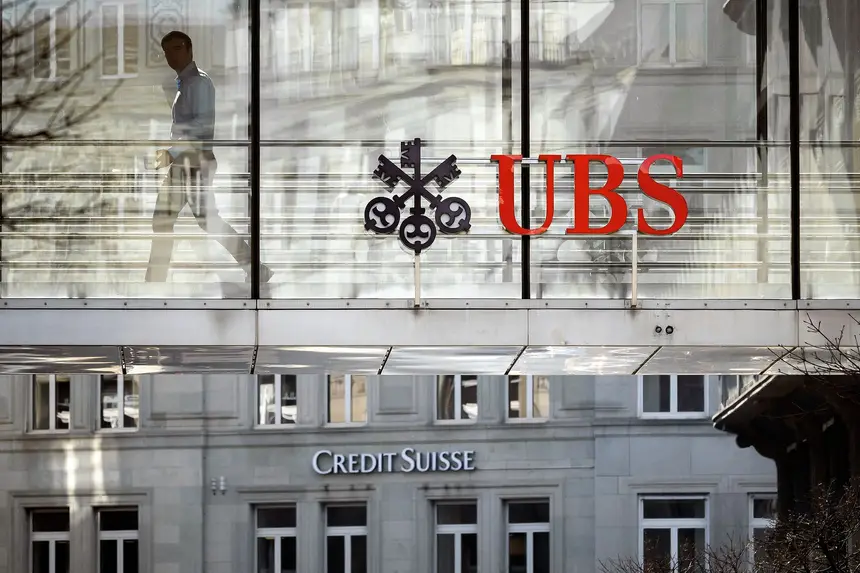

The Credit Suisse crisis brought to mind the bankruptcy of Lehman Brothers nearly 15 years ago.

APRICE COVERNI/AFP/Getty Images

Concerns about the secondary effects of higher interest rates are offset by the banks’ better capital and liquidity position

March 25, 2023 8:24

There is greater interest in management and those who manage it, greater capital strength, greater balance between deposit base and assets and ratios that ensure liquidity for larger deposit withdrawal times. These are some of the arguments that both banking authorities and analysts are currently using to say that the banking sector is safer than it was 15 years ago, when it had to face a financial crisis that led to the collapse of the American giant Lehman Brothers. This does not mean that there are no problems.

The flight of deposits that led to the closure of banks in the United States (with the summit of the Bank of Silicon Valley) was joined by the fall of Credit Suisse, with the intervention of Switzerland with the sale to UBS, and soon the fears of that date came. I’m repeating myself: There has been no shortage of headlines and opinion texts asking if this is a Lehman Brothers repeat.

Did you buy Express?

Enter the code on Revista E to continue reading

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”