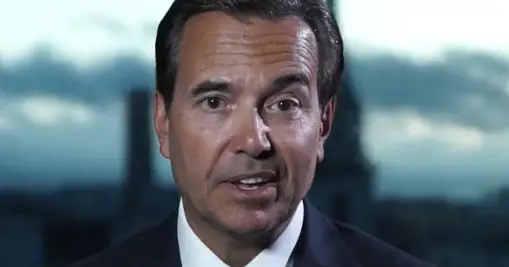

Banker Antonio Horta Osorio warned this Tuesday that difficult times are coming, with more difficulty for individuals and companies to access financing and that we must all be more “prudent”

Horta-Osório, which this year He left early as Non-Executive Chairman of Credit Suisse After controversy over non-compliance with Swiss health rules, he was speaking on a show “State of the Nation” study by the Jose Neves Foundation.

“I think we are in a time when the economic model that we live in and that people have been accustomed to in the last fifteen years will be very different from now on,” the banker began.

“Over the past 15 years, the model has been generally adequate, characterized by an abundance of capital and funding,” he added, but “at the moment we are in a period of reversal.”

As an example, he talked about inflation – which he emphasized is not temporary – and the consequent rise in interest rates, which is supposed to start in the eurozone in July, according to the European Central Bank announced (European Central Bank).

Currently, the ECB’s key rate is -0.5% and the central bank aims to reach 0% in September, rising twice in three months by 25 basis points. Other central banks – European and non-European – have raised interest rates.

Horta-Osorio warned that this ascent was no longer in dispute, but the intensity of the ascent. “It’s a completely different model than people are used to” and involves more interest in managing personal and company money, he noted.

“This will mean a higher cost of capital and difficulties in financing,” he said.

For individuals, he advised “future wisdom”, increase savings and reduce debt.

For companies, the same advice and not only: choose the longest financing, focus on strong business models, plan for shorter and continuous periods and define different scenarios for faster and better adaptation.

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”