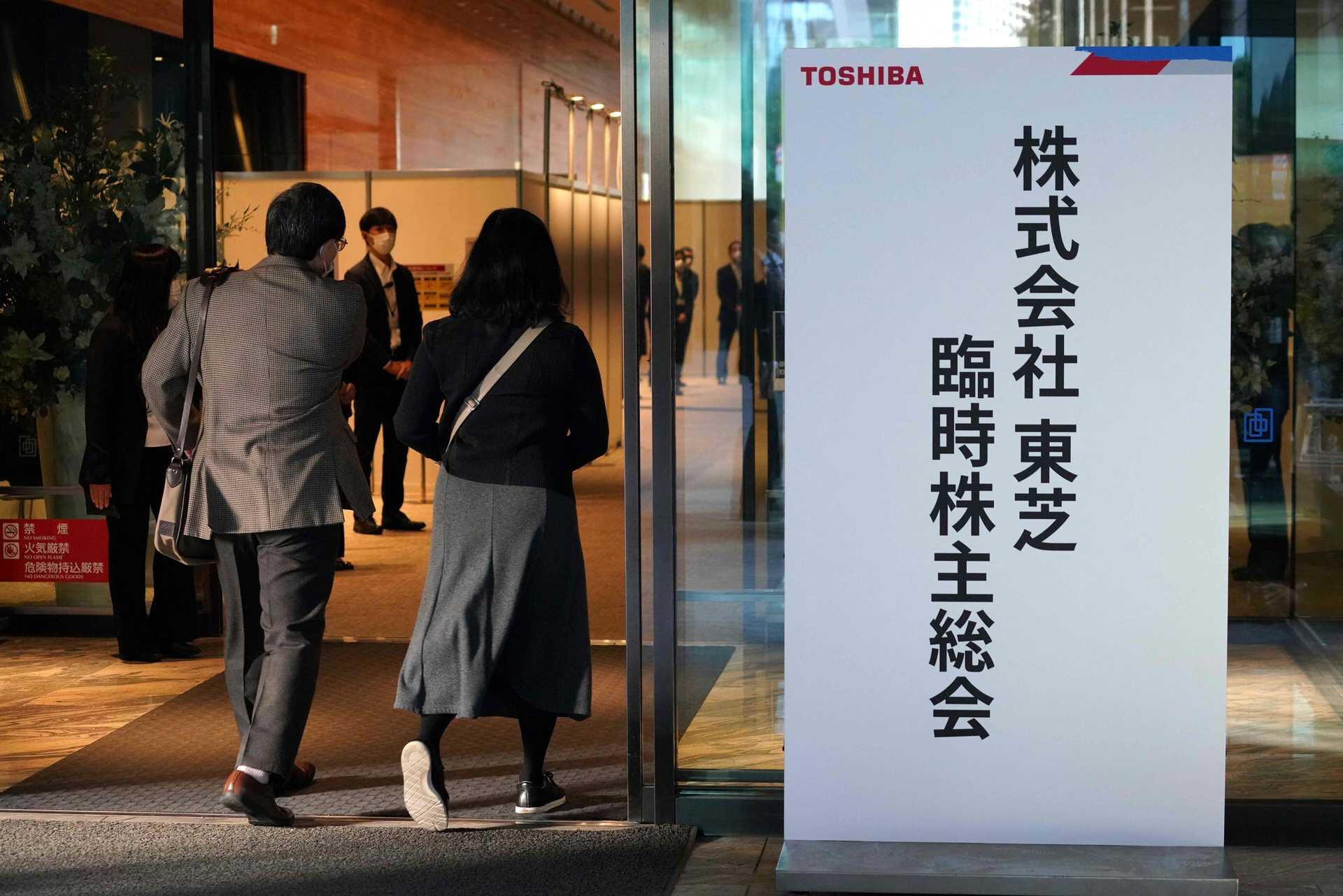

The biggest challenge for JIP is Toshiba, an investment fund that has already worked to restructure Sony's laptop division and Olympus' camera unit. After a decade of scandals, wars with foreign shareholders and uncertainty, the great Japanese technology company has a chance to turn the page.

“Toshiba’s difficulties are mainly caused by a combination of bad strategic decisions and bad luck,” said Damian Thong, head of Japan research at Macquarie Capital Securities, quoted in the global press. The problems began in 2015, when poor accounting practices were revealed in several divisions, many of which concerned the company's senior management.

For seven years, Toshiba overstated its profits by $1.59bn (about £140bn). Among these issues is a bad strategic decision, which had disastrous effects on the company's accounts. In 2016, Toshiba assumed responsibility for a multi-billion-dollar project related to the construction of a nuclear power plant that Westinghouse Electric purchased in 2015.

Three months later, Westinghouse declared bankruptcy and the company's financial collapse began. Hurt by its €6 billion liabilities, it entered into a bout of sales to try to reduce losses. Toshiba sold several businesses, including mobile phones, medical systems, and white goods.

That was not enough. At a time when companies were investing heavily in the future of technology and innovation, the company was forced to sell its chip unit, Toshiba Memory, a deal that was delayed for several months due to a dispute with one of the partners.

At the end of 2017, Toshiba was able to secure an injection of about five billion euros from foreign investors, in the opposite direction to the company's strategy. According to the BBC, an investigation conducted in 2021 revealed that Toshiba conspired with the Japanese Ministry of Commerce to stifle the interests of foreign investors, considering the company strategic for the country.

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”