Revolut has announced that it will be prior to updating our commission structure. At stake are immediate commissions that can have some impact on users.

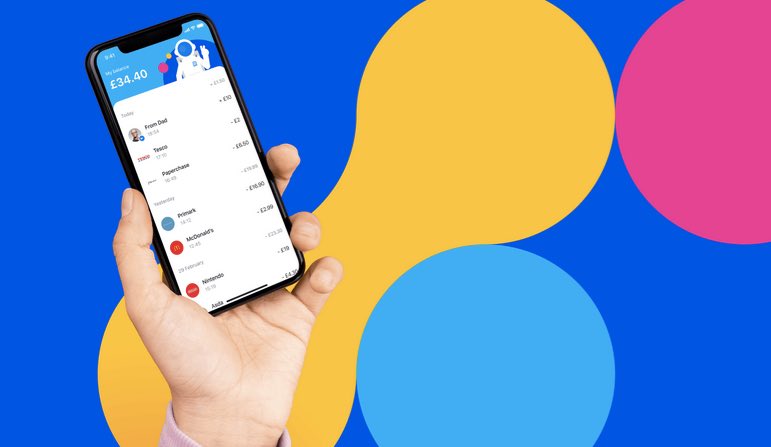

Instant Card Transfer allows you to send money directly from your Revolut account to the Visa or Mastercard debit card of a recipient who doesn't have a Revolut account.

Revolut: What changes in the new committees?

When you transfer funds from your Revolut account from a SEPA (“Single European Payments Area”) country, you are currently charged a variable fee of 0.7% per instant card transfer. This means that if you send €1,000, you will be charged a commission of €7 on that amount (total €1,007).

As of 01/08/24, a minimum commission of EUR 0.20 (or equivalent in the currency in which you send the transfer) will be offered for each instant card transfer. In some cases, this commission will replace the variable commission of 0.7%.

What are the SEPA countries?

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden are countries in the SEPA area, as are Switzerland, the United Kingdom, San Marino, Vatican City, Andorra, Monaco and the three EEA countries: Iceland, Norway and Liechtenstein.

Regarding instant card transfer fee structures, the same SEPA fees also apply Greenland, Israel and Turkey.When you transfer funds from your Revolut account to a non-SEPA card

On 01/08/24, Revolut will reduce the variable commission on instant card transfers from 2.3% to 1% for 16 countries (relevant countries listed below) outside the UK or SEPA region. This means that if you send €1,000 to one of these markets, you will be charged the full amount of €1,010 instead of €1,023.

Revolut reveals in a statement that commission structures are reviewed regularly to ensure they remain competitive, while covering fixed costs.

“Hardcore alcohol maven. Hipster-friendly analyst. Introvert. Devoted social media advocate.”