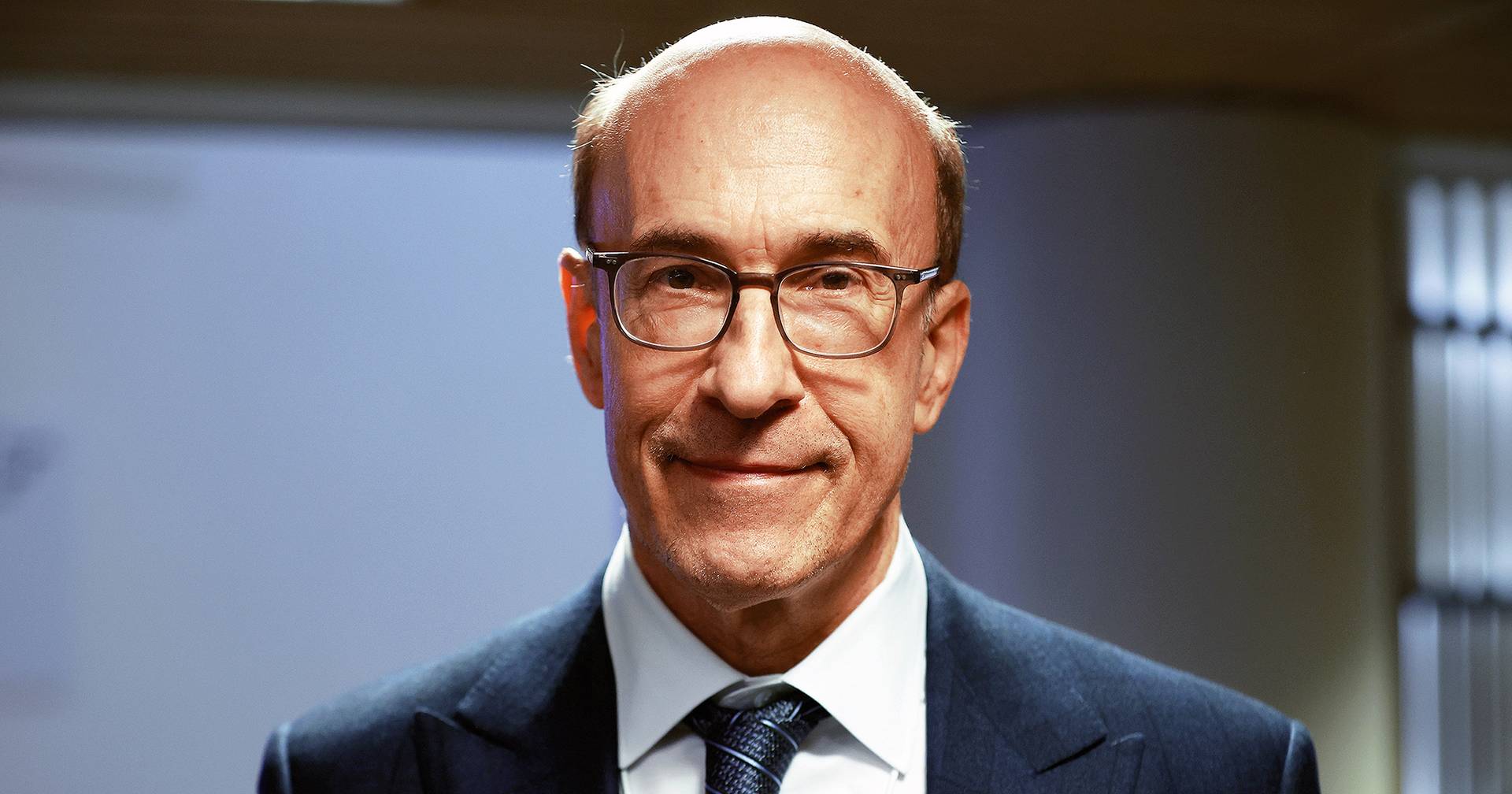

Dursun Aydemir/Anadolu Agency via Getty Images

Kenneth Rogoff, a former chief economist at the International Monetary Fund and an expert on financial crises, believes the big lesson from the collapse of Lehman Brothers in 2008 is that whenever there are signs of systemic problems, bailouts eventually happen. We saw that this year

Despite leaving Lehman Brothers to its fate, the rule that saved the financial world from the 2008 crisis is that there will always be a bailout “if there is even the slightest indication that the problem is systemic,” says the academic who co-authored the book “Lehman Brothers.” . “This Time Is Different” (ironic title), the most complete history of financial crises over eight centuries, was published in 2009. Kenneth Rogoff notes that the rule was applied again in the United States with the banking crisis last March, which involved five Countries. Banks, including Silicon Valley Bank and First Republic.

Was the Bear Stearns bailout in March correct?

At the time, the Treasury and the Fed were still in denial about the depth of the ongoing problem. Although only creditors were being bailed out – not the shareholders who lost everything – Henry Paulson and Ben Bernanke believed they were sending a signal to the markets that speculation had to end, otherwise they were certain to be in the future if they allowed the ECB to stop speculating. . Bank failure.

This is an article from Expresso Weekly magazine. Click here To continue reading.

Did you buy an expresso?

Enter the code in Revista E to continue reading

“Hardcore alcohol maven. Hipster-friendly analyst. Introvert. Devoted social media advocate.”