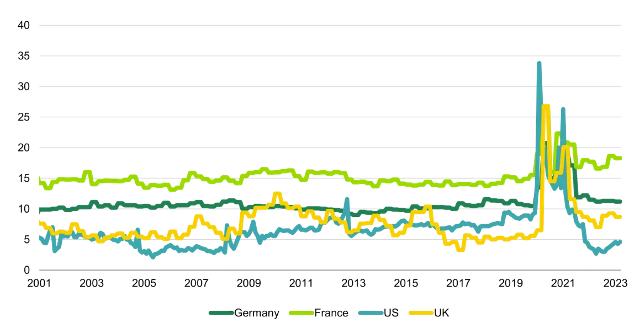

Post-pandemic, during which savings surged, savings ratio trends between the US, Europe and the UK diverged slightly from their respective peaks.

to Savings rates It was essential to sustaining growth After Covid-19. This is especially important in advanced economies, where consumption represents on average about 70% of GDP. As governments around the world provided support in different ways during the pandemic, savings rates rose to double levels in some countries. It was a historic event.

This is because income was supported by government transfers, while spending declined due to uncertainty and restrictions. However, it is interesting to note that Savings trends varied little between the United States, Europe and the United Kingdom. Changes have happened. And it’s relevant.

Saving as a percentage of disposable income

“US consumers fell below pre-pandemic spending and saving guidelines, while German, French and British consumers did not. Since consumption represents the majority of GDP in these economies, its impact on growth is very large. “This is one of the factors that explains why growth in the US has been stronger than in Europe in recent quarters,” explains Felipe Villarroel, portfolio manager at TwentyFour AM (Vontobel).

European issue

The European case deserves in-depth study. The eurozone saving rate was, on average, 12.6% of disposable income between 2015 and 2019. This changed with the onset of the pandemic, rising to an all-time high of 25.4% in the second quarter of 2021.

During pandemic lockdowns, people were able to buy durable goods but were unable to go to restaurants, go on vacation or even go to the hairdresser in most countries. And despite the decline in economic output due to Covid, most revenues remained intact. Moreover, there was no significant increase in unemployment rates in the eurozone, as governments rushed to the rescue with generous plans to suspend jobs.

With spending reduced and income stable, savings multiplied. According to European Central Bank calculations, the excess saving rate rose to 11.3% of total disposable income between the first quarter of 2020 and the fourth quarter of 2022. “This was particularly crucial at the beginning of the economic recovery to boost private consumption,” says Ulrike Kastens. It was a major factor.

As the DWS economist explains, The scenario has changed since then. Households invested their savings in homes and financial assets, such as stocks and bonds, and used them to repay loans. Meanwhile, liquid assets such as cash or bank deposits, which are also readily available for consumption, have gradually shrunk, going from a peak of 3.7% of disposable income in the first quarter of 2021 to just 0.6% in the fourth quarter of 2022. “This means there are no savings or assets available that can easily be converted into spending money.” States.

Different style in rich families

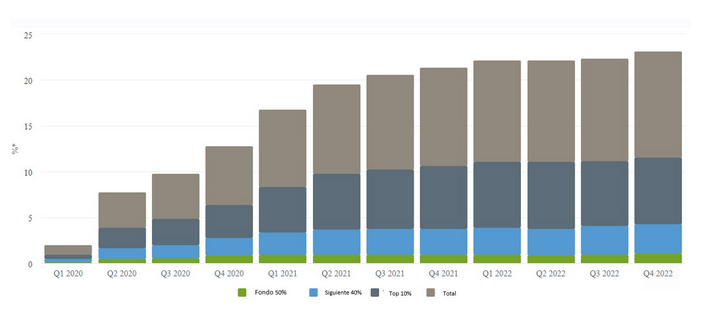

a Distribution of savings Available is also important. “The Monetary Authority’s calculations show that the richest families are the most likely to continue keeping their savings in the bank. While the richest 10% of the population had less than half of savings available in the first quarter of 2020, this number rose to nearly two-thirds in the fourth quarter of 2022.

However, rich households tend to have a lower marginal propensity to consume and tend to respond slowly to changes in their wealth. The opposite is generally true for the less affluent and lower-income groups. “When they have money, they spend it.”

“All of this means that available savings may no longer be an additional source of stimulation for consumer spending and growth. But with inflation expected to fall significantly in the coming months, it is at least possible that real income growth will pick up again, which would help the consumer and the economy as a whole a bit. But the unexpected Covid boom has come to an end.”

Distribution of surplus accumulated savings according to family groups

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”