“It would be positive if the government negotiated its proposal, and even agreed to slightly increase the value of the tax cut, in favor of approving it.”

The Organization for Economic Cooperation and Development revealed that Portugal is the eighth country in the group with the highest taxes for a single person without children and the sixth for a couple with two children. These two positions are higher than the OECD average, and reflect the tax burden currently applied in Portugal.

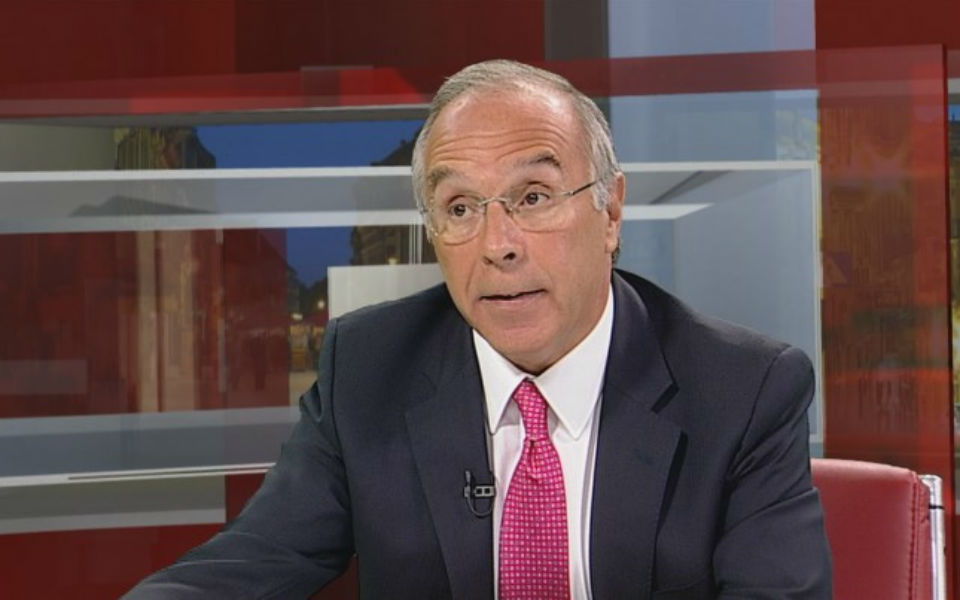

In the case of single workers, Marques Mendes states that Portugal is ahead of only “richer countries, such as Belgium, Germany or Austria”, while the situation is “worse” in the case of married couples, where the tax burden is “much higher than the organisation’s average”. Economic cooperation and development.

This is why, once again, the SIC commenter weighs in on the IRS topic.

“These data now released by the OECD validate the government’s proposal for a new cut in the tax authority. Let us now hope that the Council of the Republic will make the right decision and will not make a good solution impossible.

Luis Márquez Mendes points out that the government “presents a proposal to reduce the tax authority by 350 million euros. Since there is no majority in Parliament, it would be positive for the government to negotiate its proposal, and even accept to increase the value of the tax reduction slightly, in favor of approving it,” especially since The issue is being discussed in the specialty. Without risking the proposal being rejected by the opposition.

“On the other hand, it would be positive if the opposition parties did not make unsustainable financial demands. Increasing, for example, the government's proposal from 350 to 500 million may still be acceptable. Doubling it or more, as some suggest, could seriously jeopardize public finances. “It takes balance, dialogue and common sense,” the former PSD chief said.

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”