Business leaders have urged the new prime minister to urgently tackle the economic crisis, as new estimates suggest the impending recession will last longer than expected.

The British Chamber of Commerce (BCC) warned that “action is now needed”, as it lowered its forecast for next year amid a “deteriorating economic outlook”.

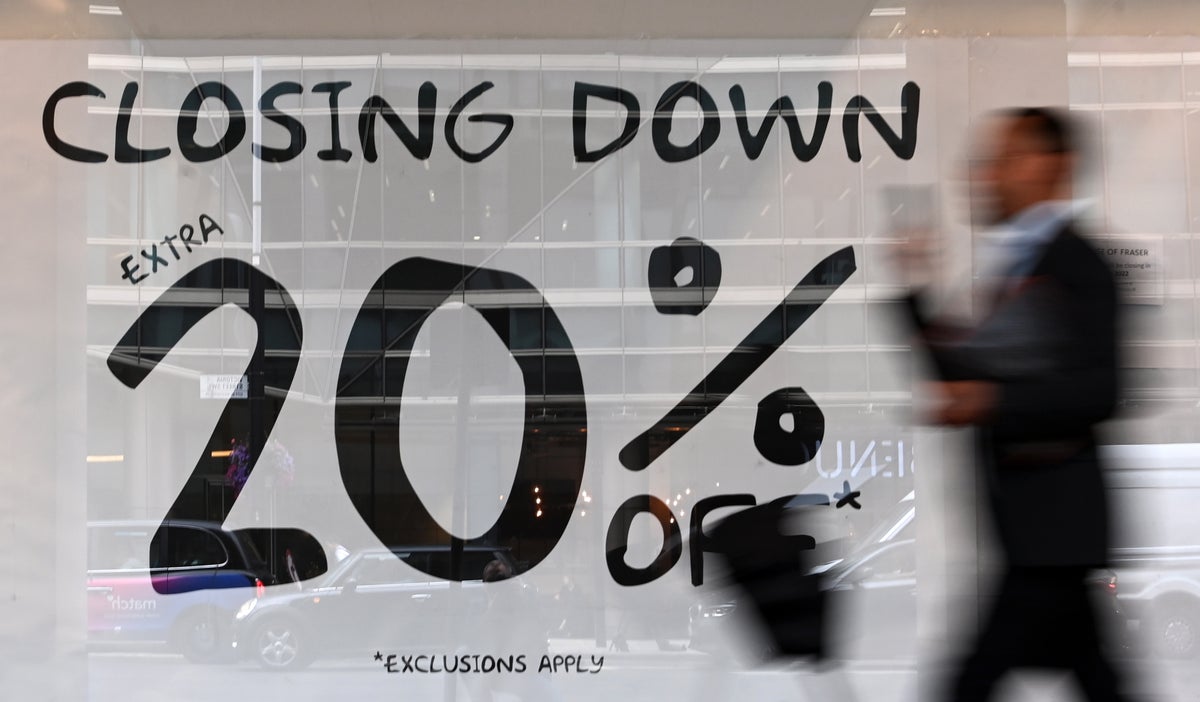

Figures showed major streets experienced a slowdown in post-Covid recovery as cost-of-living pressures dampened consumers.

Total UK traffic fell 12.4% in August compared to the same month three years ago, according to the British Retail Consortium (BRC).

Exceptionally high costs are beginning to affect consumers and businesses amid rampant inflation.

These pressures are “only expected to increase as Christmas approaches, with the UK economy already in recession,” said Alex Fitch, director of policy at the BCC.

“Facing these pressures should be at the top of the inbox for the new prime minister when he takes office next week,” he added.

We have revised our projected inflation rate by four percentage points to a new high of 14%. Inflation is pervasive and affects not only the cost of doing business, but also the ability of some businesses to keep their doors open. Action is required now.”

The BCC has lowered its UK GDP growth forecast for 2022 to 3.3% (from 3.5% in the second quarter) and now expects a recession for the UK economy this year, with negative economic growth for three years. And the third quarter. Fourth quarter of 2022.

“Time is running out fast. The government must step up its efforts and do whatever is necessary to protect businesses, livelihoods and jobs.”

Separately, house prices will likely come to a halt in the coming year as inflation continues and mortgage rates continue to rise, but rental prices will continue to rise despite affordability pressures on renters, the real estate agent and the leases.

The Hamptons said it expects prices to remain unchanged in the fourth quarter of 2023 compared to the same period in 2022, with a change of 0% across the UK.

Sales are expected to hit next year, with a drop caused by mortgage buyers, primarily first-time buyers, according to expectations.

The real estate agent said 2024 could be the “year of recovery” before the BoE’s key rate returns “to its new normal, most likely at 1.75 percent”.

He expects rents to increase by 5% annually in 2023 and 2024, before the rate of increase slows slightly to 4% in 2025.

“Writer. Analyst. Avid travel maven. Devoted twitter guru. Unapologetic pop culture expert. General zombie enthusiast.”